The College for Financial Planning (CFFP) is a leader in providing education and certification for financial planning professionals. As we approach 2024, understanding the College for Financial Planning 2024 limits is crucial for prospective students, current enrollees, and industry professionals. This comprehensive guide will delve into the key aspects of these limits, their implications, and how to navigate them effectively.

What Are the College for Financial Planning 2024 Limits?

The College for Financial Planning 2024 limits encompass various regulations, guidelines, and constraints that affect the institution’s certification programs, course structures, and overall educational offerings. These limits are designed to maintain the quality, relevance, and rigor of the programs provided by the CFFP.

Boost Mobile Insurance Claim: A Step-by-Step Guide to Protecting Your Device

We’ve all been there—one moment, you’re texting a friend, and the next, your phone slips out of your hand and lands screen-first on the pavement. Accidents happen, and that’s where having insurance on your mobile device can be a lifesaver. If you’re a Boost Mobile customer, you might be wondering how to file an insurance claim when disaster strikes. In this post, I’ll walk you through the entire process, step by step, so you can get your device repaired or replaced as quickly and smoothly as possible.

Why You Need Boost Mobile Insurance

Before diving into the claim process, let’s talk about why mobile insurance is essential. Smartphones are more than just gadgets; they’re our lifelines to work, family, and entertainment. With Boost Mobile insurance, you’re protected against life’s unexpected mishaps—whether it’s a cracked screen, water damage, or even theft. The peace of mind that comes from knowing you’re covered is well worth the investment.

Step 1: Confirm Your Coverage

The first step in filing a Boost Mobile insurance claim is to ensure that your device is actually covered under the insurance plan. Boost Mobile offers insurance through Brightstar, a company that provides protection plans for various carriers. If you’ve opted for this coverage when purchasing your device, you’re in good hands.

To check your coverage:

- Log in to your Boost Mobile account.

- Navigate to the “My Device” section.

- Look for any insurance details or contact Boost Mobile customer support to confirm.

Step 2: Gather Necessary Information

Before you file your claim, make sure you have all the necessary information at hand. This will make the process much smoother and faster. Here’s what you’ll need:

- Your mobile number: This is tied to your Boost Mobile account and will be required to verify your identity.

- The make and model of your device: Knowing your device details will help expedite the claim.

- Details of the damage or loss: Be prepared to explain what happened to your device—whether it was lost, stolen, or damaged.

- Date of the incident: The insurance provider will ask for the date when the incident occurred.

Having these details ready will make the claim process quicker and reduce any potential delays.

Step 3: File the Claim

Now that you’ve confirmed your coverage and gathered all the necessary information, it’s time to file the claim. You can do this either online or by phone.

Filing Online:

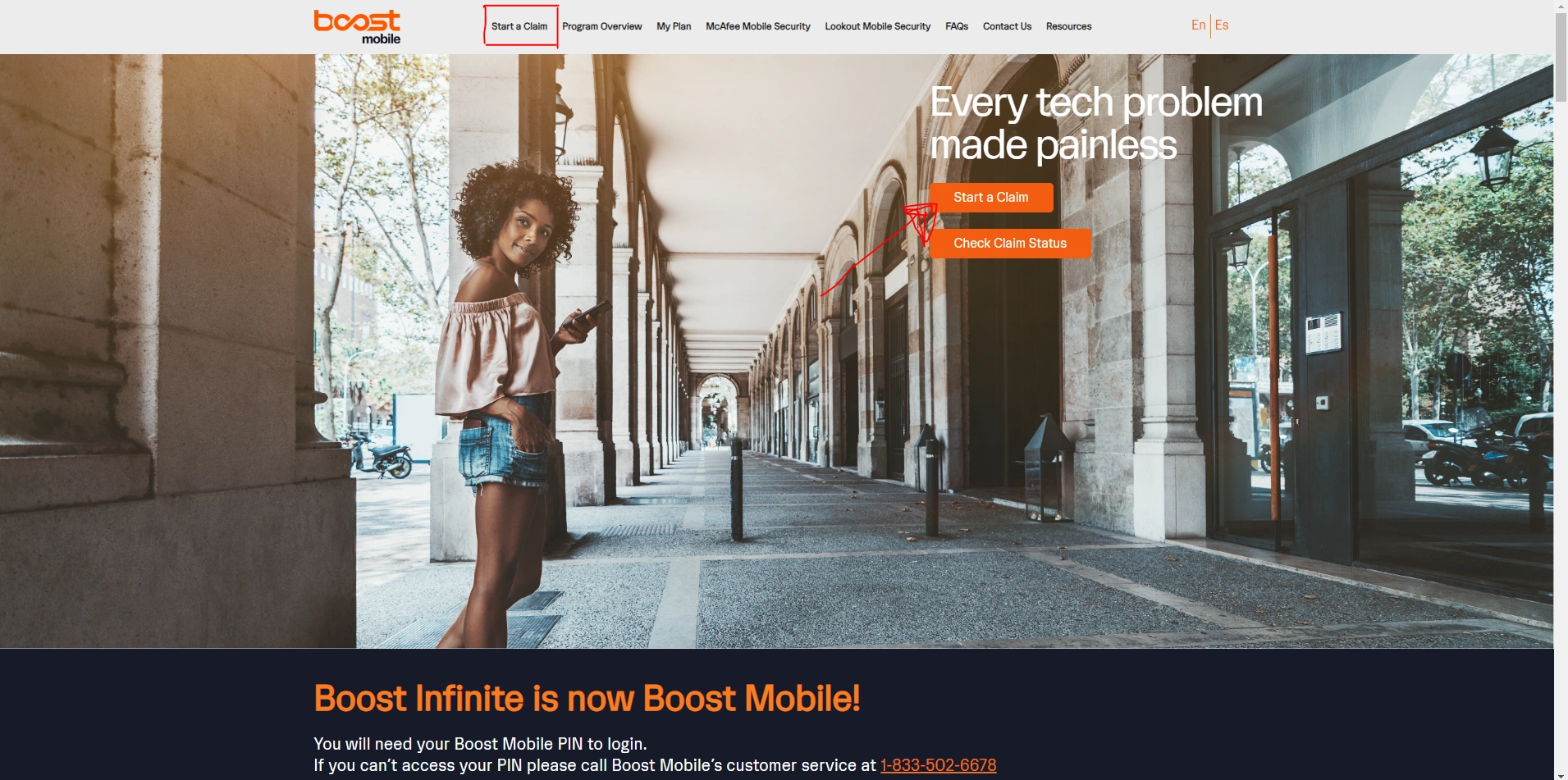

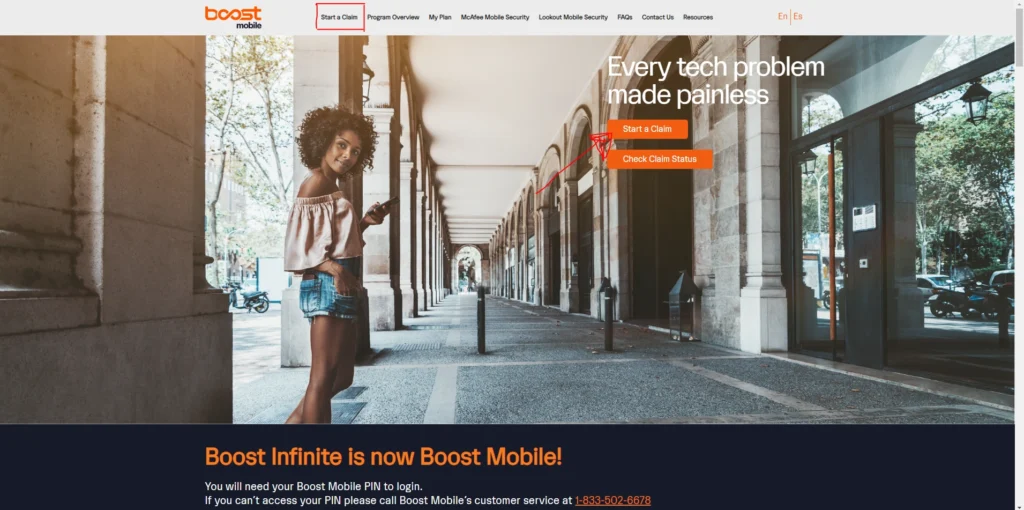

- Visit the Boost Mobile insurance website or the Brightstar claims page.

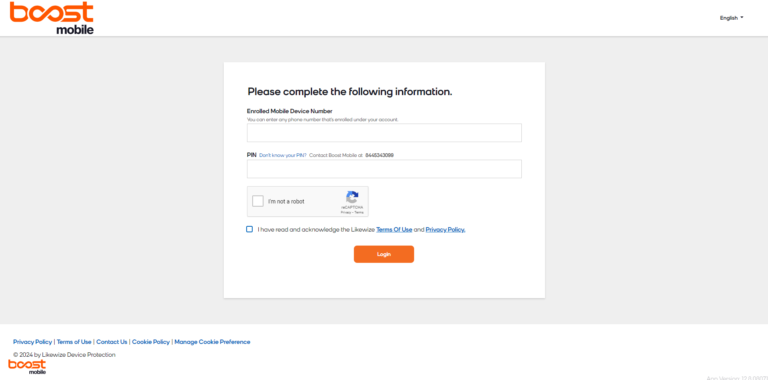

- Log in with your Boost Mobile credentials.

- Select the “File a Claim” option.

- Follow the prompts to provide details about the damage, loss, or theft.

- Submit the claim and note the confirmation number provided.

Filing by Phone:

If you prefer to file your claim by phone, you can call Boost Mobile’s insurance claim hotline at

1-844-534-3099.

- Dial the hotline and follow the automated instructions.

- When prompted, provide your mobile number and other necessary details.

- Describe the incident, including when and how the damage or loss occurred.

- Confirm the information and submit your claim.

Whether you file online or by phone, make sure to keep a record of your claim number. This will be important for tracking the status of your claim.

Step 4: Pay the Deductible

Once your claim is approved, you’ll need to pay a deductible before your device can be repaired or replaced. The amount of the deductible varies depending on the make and model of your phone, but it’s generally much lower than the cost of a new device. You can pay this fee online or over the phone when you file your claim.

Step 5: Receive Your Replacement or Repair

After you’ve paid the deductible, you’ll either receive a replacement device or instructions on how to get your phone repaired. Here’s what to expect:

- Replacement: If your phone is beyond repair, Boost Mobile will ship a replacement device to your address, usually within a few business days. The replacement phone will be the same make and model, or a similar one if your model is no longer available.

- Repair: If your phone can be repaired, you may be directed to a local repair center or sent a prepaid shipping label to mail your device to an authorized repair facility. The turnaround time for repairs can vary, but you’ll typically have your phone back within a week.

Step 6: Set Up Your New or Repaired Device

When you receive your replacement or repaired device, the final step is to set it up. Transfer your SIM card, restore your apps and data from a backup, and you’re good to go. If you run into any issues, Boost Mobile’s customer support is available to help.

Tips for a Smooth Claim Process

- Act Quickly: File your claim as soon as possible after the incident to avoid any complications.

- Be Honest: Provide accurate information about the incident to ensure your claim is processed without delays.

- Keep Documentation: Save any emails, receipts, or confirmation numbers related to your claim for future reference.

Final Thoughts

Filing an insurance claim with Boost Mobile is a straightforward process, but knowing the steps in advance can save you time and stress. By following this guide, you’ll be back to texting, scrolling, and calling in no time. Remember, having insurance is like having a safety net—it’s there to catch you when life’s little accidents happen.

If you ever need to file a claim, don’t hesitate to do so. It’s a simple process that can save you a lot of headaches down the road.

Frequently Asked Questions.

1. What does Boost Mobile insurance cover?

Boost Mobile insurance typically covers accidental damage (like cracked screens or liquid damage), theft, loss, and mechanical breakdowns after the manufacturer’s warranty expires. It’s important to check your specific plan details to know exactly what’s covered.

2. How do I file a Boost Mobile insurance claim?

You can file a claim online through the Boost Mobile insurance website or by calling their insurance claim hotline at 1-844-534-3099. Be prepared to provide your mobile number, device details, and a description of the incident.

3. How long does it take to get a replacement device?

Once your insurance claim is approved and you’ve paid the deductible, you can expect to receive a replacement device within a few business days. Shipping times may vary depending on your location and the availability of the replacement model.

4. What is the deductible for a Boost Mobile insurance claim?

The deductible varies depending on your device’s make and model. It’s usually much lower than the cost of replacing the device outright. You’ll be informed of the exact amount when you file your claim.

5. Can I track the status of my Boost Mobile insurance claim?

Yes, after filing your claim, you will receive a claim number that you can use to track the status of your claim online or by contacting Boost Mobile’s customer support. This will help you stay updated on the progress of your repair or replacement.